Federal Budget Summary 2024-25

14 May 2024

Summary for client

On Tuesday evening, the treasurer Jim Chalmers handed down his third Labor budget.

A Budget surplus of $9.3 billion is forecasted for 2023-24 which will be short-lived with an underlying cash deficit of $28.3 billion is expected in 2024-25 (and a $42.8 billion deficit for 2025-26). The Budget noted a weak and uncertain global economy where growth is forecast to remain subdued over the next few years.

Inflation is expected to remain elevated at 3.5% for 2023-24, which is then expected to fall to 2.75% in 2024-25.

The Government plans to spend billions to cut energy bills and rent, lowering headline inflation and providing relief for voters grumbling about cost of living pressures ahead of an election next year.

In this summary, we highlight some of the Government’s key initiatives.

It is important to note the Budget announcements are still only proposed at this stage and to be legislated. Changes can also be made prior to these proposals becoming law.

Article published here: Federal Budget Summary 2024-25 (mcusercontent.com)

Cost of living and Government Assistance

Energy bill relief fund for all households and eligible small businesses

The Government will provide $3.5 billion over 3 years from 2023-24 to extend and expand the Energy Bill Relief Fund to provide a $300 rebate to all Australian households and a $325 rebate to eligible small businesses on their 2024-25 electricity bills.

This builds on the $1.5 billion available for energy rebates provided by the Commonwealth in 2023-24 year under the existing scheme. All Australian households, including households in the external and non-self-governing territories, are eligible for the $300 annual rebate that will be applied in quarterly instalments to electricity bills from 1 July 2024.

Small businesses who meet the definition of electricity ‘small customer’, as determined by their annual electricity consumption threshold, are eligible for a $325 annual rebate.

State and territory Governments will administer the rebates and deliver the payments through retailers. In most cases, your electricity providers will automatically apply the bill relief to your electricity account and you will not be required to take any action.

Pharmaceutical Benefits Scheme (PBS) changes

Pharmaceutical Benefits Scheme changes: The Government is working to finalise the new Eighth Community Pharmacy Agreement, supported by up to an additional $3 billion in funding.

As part of the Agreement, instead of rising with inflation, there will be a one-year freeze on the maximum PBS patient co-payment for everyone with a Medicare card and a five-year freeze for pensioners and other concession cardholders.

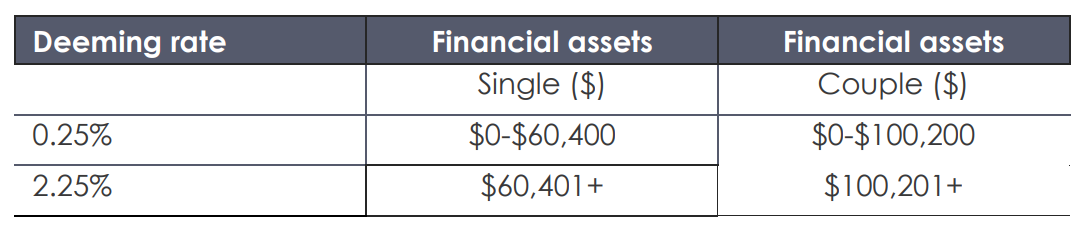

Social Security deeming rates freeze for a further 12 months

The Government announced that it will extend the freezing of the social security deeming rates at their current rate for a further 12 months until 30 June 2025 to help with cost-of-living pressures.

Since 1 July 2023, the threshold amount for financial investments is $60,400 (for single) and $100,200 (for members of a couple).

For the purposes of the social security income and assets tests, the deeming rules provide that any financial investments are earning a certain rate of income, no matter what (if any) income they are actually earning. If the actual income pensioners receive from their investments is more than the deemed income, the extra income is not counted when assessing their rate of pension, benefit or allowance.

This will benefit approximately 876,000 Centrelink payment recipients, including 450,000age pensioners.

Strengthening Medicare and the care economy

The Government is investing $2.8 billion to continue its commitment to strengthen Medicare. This includes package to address pressures facing the health system, which provides:

Funding to support older Australians avoid hospital admission, be discharged from hospital earlier and transition to other appropriate care.

Deliver a further 29 Medicare Urgent Care Clinics and boost support for regional clinics.

$90 million to address health workforce shortages by making it simpler and quicker for international health practitioners to work in Australia.

Increase to rent assistance

The Government will provide $1.9 billion over five years from 2023-24 (and $0.5 billion per year ongoing from 2028-29) to increase all Commonwealth Rent Assistance maximum rates by 10% from 20 September 2024 to help address rental affordability challenges for recipients. This builds on the 15% increase in September 2023 and will take maximum rates over 40% higher than in May 2022.

The maximum Rent Assistance for a single person is currently $188.20 per fortnight and varies depending on the amount of rent paid and the family situation of the person.

Mental health support

Almost half of Australians will experience a mental health concern in their lifetime. The Government is committed to creating a system where Australians can access quality and affordable care when and where they need it.

The Government is committing $888.1 billion on mental health package over eight years to help people get the care they need and making it easier to access services.

From 1 January 2026, every Australian will be able to access a free service without a referral.

Carer Payment improve flexibility

From 20 March 2025, the Government will make amendments to the eligibility criteria for Carer Payment recipients, the existing 25 hour per week participation limit will be amended to 100 hours over four weeks. The participation limit will no longer capture study, volunteering activities and travel time and will only apply to employment.

Carer Payment recipients exceeding the participant limit or their allowable temporary cessation of care days will have their payments suspended for up to six months, rather than cancelled. Recipients will also be able to use single temporary cessation of care days where they exceed the participation limit, rather than the current seven day minimum.

Tax and Superannuation

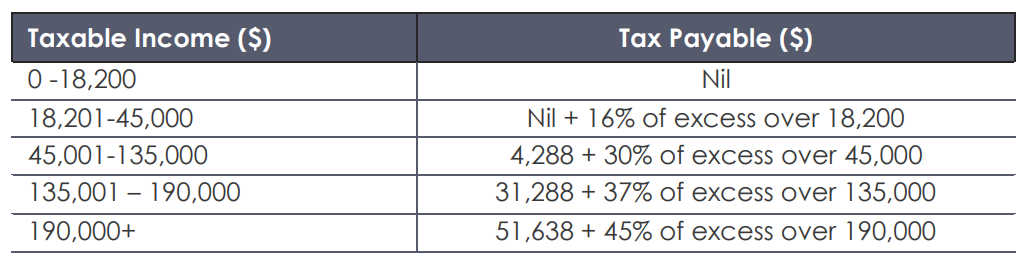

No changes to stage 3 personal income tax cuts

The Government made no further announcements to the legislated revised stage 3 tax cuts which will commence from 1 July 2024. The Treasurer said all 13.6 million taxpayers will receive a tax cut from 1 July 2024. The average annual tax cut is $1,888 (or $36 a week).

Resident tax rates and thresholds from 2024-25 onwards:

Small business instant asset write-off

The Government will improve cash flow and reduce compliance costs for small businesses by extending the current instant asset write-off concession for another 12 months.

Small businesses, with aggregated annual turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

Paying superannuation on Government funded Paid Parental Leave Payment (PPL)

The Government will provide $1.1 billion over four years from 2024-25 (and $0.6 billion per year ongoing) to strengthen Australia’s government-funded PPL for births and adoptions on or after 1 July 2025. Eligible parents will receive an additional payment based on the Superannuation Guarantee (12%) of their PPL payments), as a contribution to their superannuation fund. Both partners are entitled to superannuation on their PPL payment.

This measure will help normalise parental leave as a workplace entitlement, like annual and sick leave, and reduce the impact of parental leave on retirement incomes.

Aged care

Regulatory reform and improved support

Additional funding is being provided to:

Enhancements to critical aged care digital systems so they remain compliant and ready for the introduction of the new Aged Care Act from 1 July 2025.

$531.4 million in 2024-25 to release 24,100 additional home care packages in 2024-25.

$174.5 million over two years from 2024-25 to fund the ICT infrastructure needed to implement the new Support at Home Program and Single Assessment system from 1 July 2025.

Attract and retain aged care workers, collect more reliable data, and improve the outcomes for people receiving aged care services.

Reduce wait times for the My Aged Care Contact Centre due to increased demand and service complexity.

Allow states and territories to continue to deliver the Specialist Dementia Care Program.

Implement the new Aged Care Act, including Government activities, program management and extension of the Aged Care Approval Round.

Extend the Palliative Aged Care Outcomes program and the program of Experience in the Palliative Approach program.

Housing

Making it easier to buy a home

The Government is giving more money to build homes for Australians faster, improve housing infrastructure, train more construction workers, and support affordable housing and homelessness services. This includes:

$423.1 million over five years starting from 2024-25 to help states and territories provide social housing and services for homelessness under a new agreement.

$1 billion in 2023-24 to help states and territories build infrastructure for new housing through a new program.

Increasing the government's guarantee of housing loans by $2.5 billion to $10 billion, which helps the Affordable Housing Bond Aggregator.

Funding for 20,000 new training spots in construction-related courses at TAFEs and other training providers, including more access to pre-apprenticeship programs.

Allowing foreign investors to buy established rental properties at a lower fee if they are used for long-term rentals.

Funding for crisis accommodation for people fleeing domestic violence and for youth, including more grants instead of loans, totaling $700 million.

$1.9 billion in low-interest loans to help community housing providers build social and affordable housing, using the Housing Australia Future Fund and the National Housing Account.

Your Vision Financial Solutions Pty Ltd ABN 64 650 296 478 and its Advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This article has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this article you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.