Maximising Your Wealth: Expert Tips for High-Income Earners to Manage and Reduce Debt

As a high-income earner, you may find yourself facing the challenge of managing debt while balancing other financial priorities. While your income provides a solid foundation for wealth accumulation, taking proactive steps to manage and reduce debt can help maximise your financial potential. Here are some expert tips to guide you through this process:

1. Assess Your Financial Situation

“Risk comes from not knowing what you're doing. “- Warren Buffett

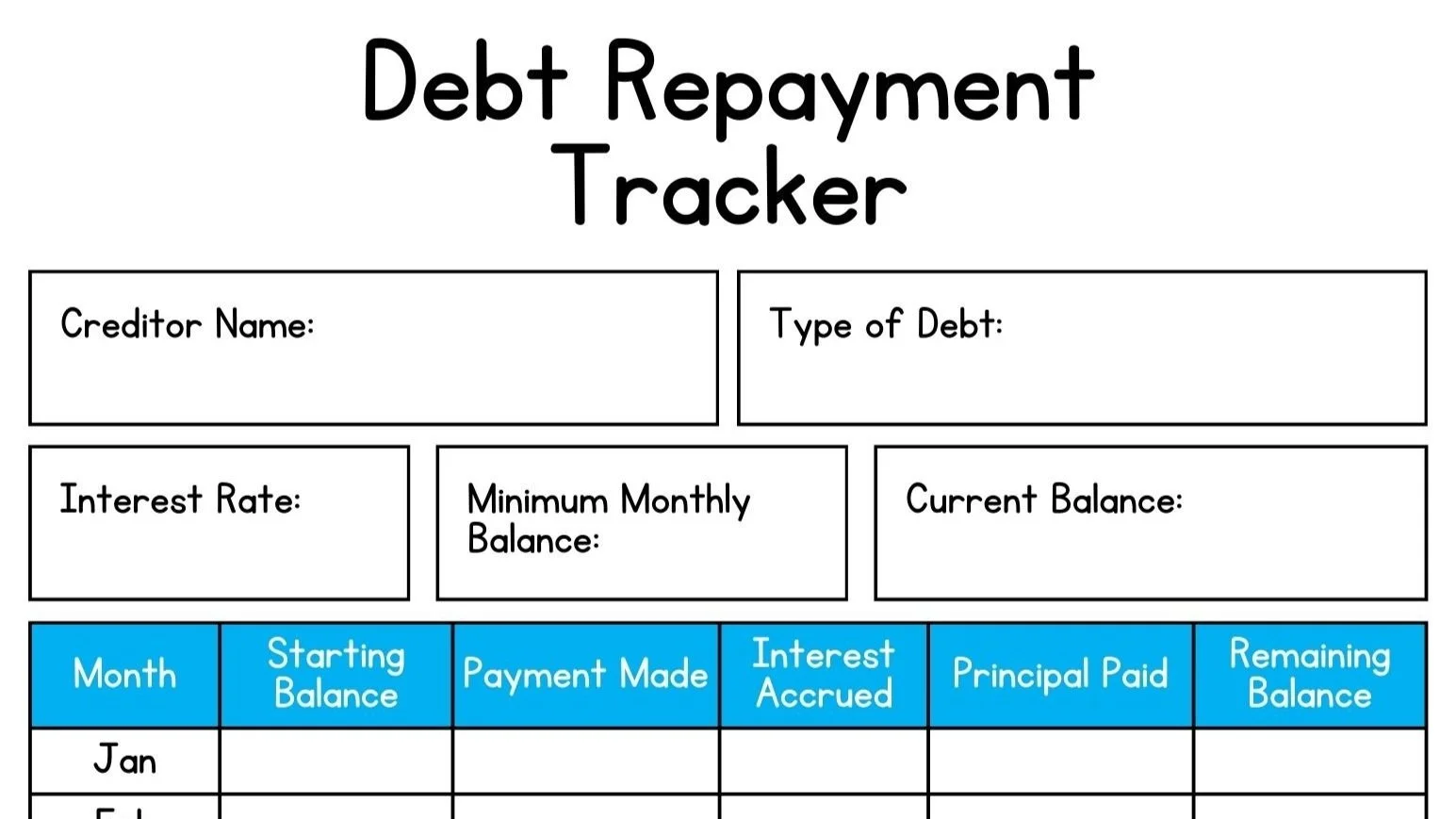

Start by getting a clear picture of your financial situation. List all your debts, including mortgages, investment loans, and any other outstanding obligations. Include details such as interest rates, minimum monthly payments, loan type (interest only or principal & interest) and loan term. Then categorise them as bad debt (non-deductible loans like your home loan and personal loans like car loans or credit card debt) vs good debt (income producing loans like your investment property loan, business loan, investment/share portfolio loan). This comprehensive overview will help you identify which debts may need to be refinanced or restructured. It is best to work on this with your financial planner.

2. Prioritise High-Interest Debts

High-interest debts, such as credit card balances, can quickly erode your wealth if not addressed promptly. Focus on paying off these debts first to reduce the overall amount of interest you’ll pay. Consider making larger payments towards these debts while maintaining minimum payments on others. This strategy can help you save a lot of money in the long run.

3. Review Your Investment Portfolio

As a high-income earner, you likely have a diverse investment portfolio. Review your investments to ensure they’re aligned with your financial goals and risk tolerance. Consider whether it is appropriate to sell investments to pay off high-interest non-deductible debts.

4. Consolidate Your Debts

Debt consolidation can simplify your repayment process by combining multiple debts into a single loan with a lower interest rate. This approach not only makes it easier to manage your payments but can also reduce the amount of interest you pay over time. Consult with a financial advisor to determine if debt consolidation is a viable option for you and to ensure you do this right and don’t jeopardise any tax deductibility of your current loans.

6. Seek Professional Advice

Navigating debt can be complex, and seeking professional advice can provide you with tailored strategies to manage and reduce your debt effectively. A financial advisor can help you create a personalised debt repayment plan, explore consolidation options, and provide ongoing support to keep you on track. Contact us today to take control of your finances and maximise your wealth. Our expert team is here to provide you with the guidance and support you need to achieve financial stability and peace of mind. We also work closely with finance experts / mortgage brokers as well as your accountant to ensure you have the right solution and structure.

“I believe that at the end of the day money is only as good as the memories it buys us”

-PATRICIA GARCIA, OWNER AND FINANCIAL ADVISER

Your Vision Financial Solutions Pty Ltd ABN 64 650 296 478 and its Advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This article has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this article you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.