The True Value of Financial Advice: Why Working with a Financial Adviser Matters

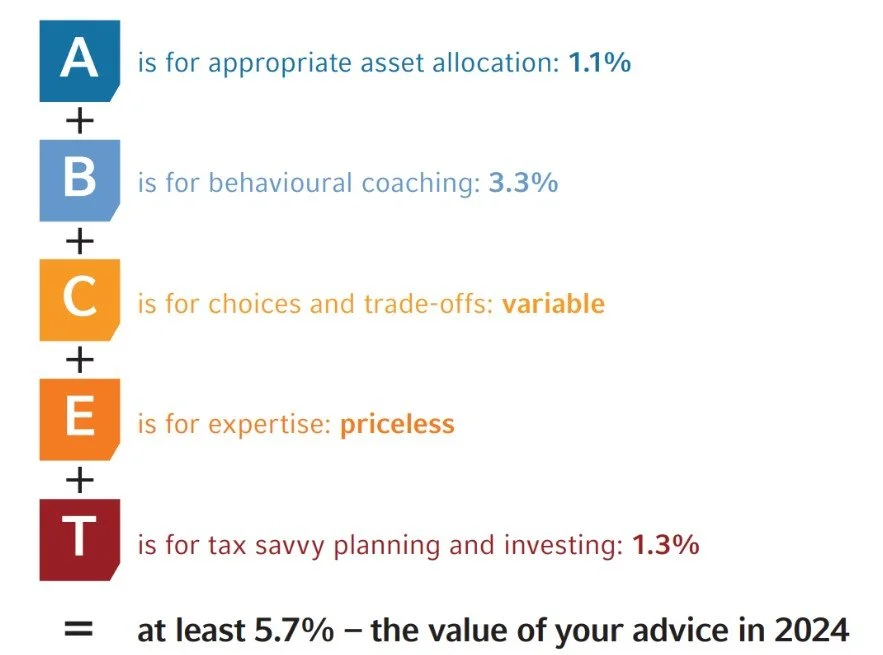

In an increasingly complex financial landscape, the role of a financial adviser has become more valuable than ever. Financial advisers provide a holistic service that goes beyond mere investment advice. According to Russell Investments annual Value of an Adviser report Financial Advisers ave added at least 5.7% in value over the past year. Here’s how they add significant value to clients:

1. Personalised Asset Allocation

A financial adviser helps craft a personalised investment strategy tailored to an individual's unique circumstances, goals, and risk tolerance. This can lead to significantly better outcomes over time compared to a generic, one-size-fits-all approach. For example, the 2024 Value of an Adviser Study by Russell Investments shows how an advised portfolio can deliver a 1.4% higher annual return, translating into thousands more for retirement, simply by helping guide clients through appropriate asset allocation given the client’s age, investment horizon and investment goals.

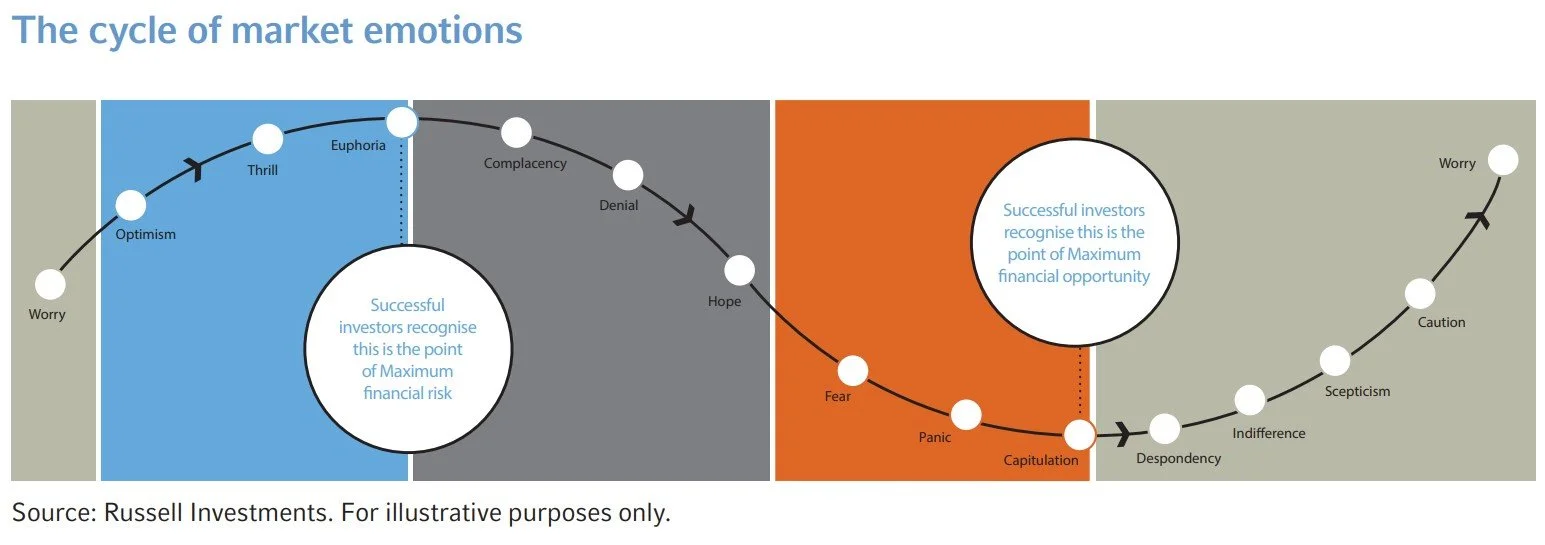

2. Behavioral Coaching

Investors often fall prey to emotional decisions, such as selling in a market downturn or chasing high-performing assets during a boom. An adviser acts as a behavioral coach, helping clients stay focused on their long-term goals. According to Why Work with a Financial Adviser by Russell Investments, advisors guide clients through market cycles, preventing costly mistakes that can stem from fear or greed.

Image from Why Work with a Financial Adviser by Russell Investments

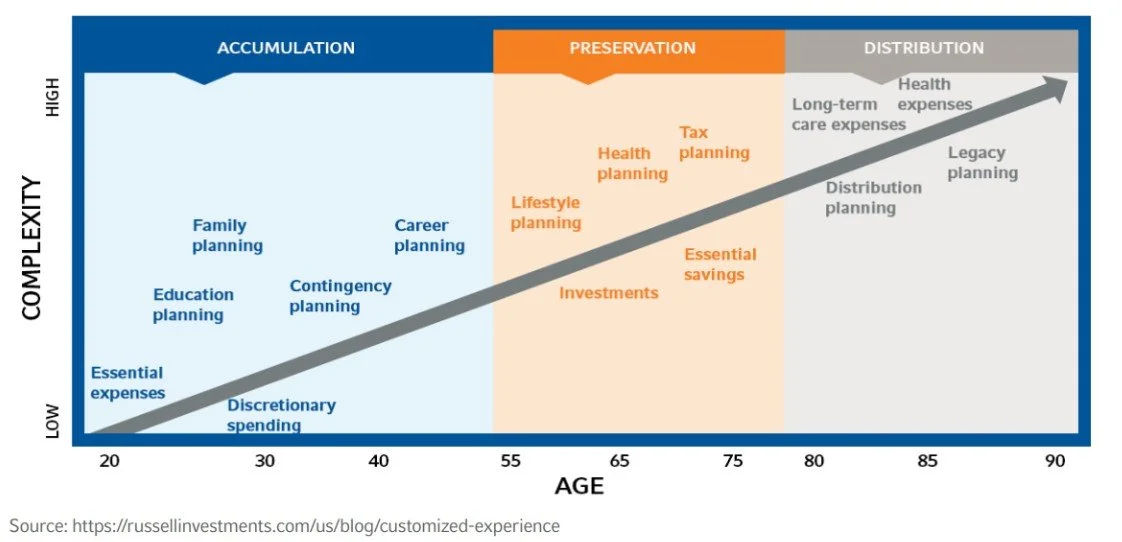

3. Expert Guidance on Choices and Trade-Offs

Financial decisions are rarely straightforward. Advisers help navigate complex trade-offs, such as balancing immediate desires with long-term financial security. They guide clients through pivotal life stages, from funding a child’s education to planning for retirement, offering insight into both the benefits and potential pitfalls of various choices.

Image from 2024 Value of an Adviser Study by Russell Investments

4. Tax-Savvy Planning and Investing

Effective tax planning can significantly impact an individual’s net wealth. Advisers help optimise investments for tax efficiency, maximising benefits through strategies such as superannuation contributions, tax-effective investments, and income splitting. According to the 2024 Value of an Adviser Study by Russell Investments, this can add around 1.3% per annum to an investor’s return.

Image from 2024 Value of an Adviser Study by Russell Investments

5. Emotional and Practical Support

Advisers also serve as guides, gurus, and even gladiators, providing both emotional support and expert advice during life's ups and downs. They advocate on behalf of clients during critical times, such as when insurance claims are denied, ensuring their best interests are protected (Why Work with a Financial Adviser by Russell Investments).

The Financial Impact

The combined value provided by financial advisers, from asset allocation to behavioral coaching and tax strategies, can add up to an estimated 5.7% annually to an investor's portfolio, according to the 2024 Value of an Adviser Study by Russell Investments. This demonstrates that the benefits of working with an adviser often far outweigh the costs.

Image from 2024 Value of an Adviser Study by Russell Investments

Conclusion

The value of financial advice extends beyond mere investment guidance. It's about having a trusted partner to navigate the complexities of personal finance, offering tailored strategies, expert knowledge, and emotional support. In a world filled with financial uncertainties, a financial adviser stands as a key asset in achieving long-term financial stability and peace of mind.

Reference:

Russell Investments. 2024 Value of an Adviser Study. 2024.

Russell Investments. Why Work with a Financial Adviser. 2024.

Your Vision Financial Solutions Pty Ltd ABN 64 650 296 478 and its Advisers are Authorised Representatives of Fortnum Private Wealth Ltd ABN 54 139 889 535 AFSL 357306. This article has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this article you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.